The investment fund RedBird IMI is 75 percent backed by Sheikh Mansour bin Zayed Al-Nahyan, vice president and deputy prime minister of the UAE…reports Asian Lite News

The Abu Dhabi-backed takeover of the Telegraph may influence the media group “in a way that could potentially act against the public interest,” communications regulator Ofcom warned the UK’s culture secretary on Tuesday.

Culture Secretary Lucy Frazer told the House of Commons that she may refer the deal for an in-depth review by the Competition and Markets Authority over press freedom concerns raised by Ofcom, the Telegraph reported.

She said that the proposed buyers of the Daily Telegraph newspaper and the Spectator would have ten working days to respond to her proposal or face a more thorough phase-two investigation.

This comes less than a week after the British government announced plans to ban foreign-state ownership of British newspapers.

The law, sparked by the Telegraph bid, is due to come into force in the next few months and likely to kill the UAE-backed deal as a phase-two investigation would take about six months to complete.

In November, RedBird IMI, a joint venture between US fund manager RedBird Capital and Abu Dhabi International Media Investments, reached a deal with former Telegraph owners, the Barclay family, that saw RedBird IMI pay off bank debts in exchange for control of the Telegraph Media Group.

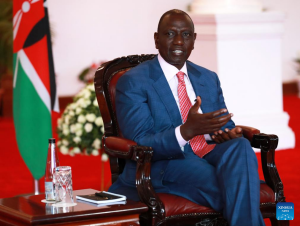

The investment fund RedBird IMI is 75 percent backed by Sheikh Mansour bin Zayed Al-Nahyan, vice president and deputy prime minister of the UAE.

Although the Telegraph bidder vowed that Shaikh Mansour would be a “passive investor,” British lawmakers and journalists voiced their objection to the deal due to concerns that such an acquisition would threaten press freedom in the UK.

Frazer said in her written statement on Tuesday that “Ofcom has found that it is or may be the case that the potential merger situation may be expected to operate against the public interest, having regard to the specified public interest considerations.

“In particular, they consider that International Media Investments (IMI), a majority partner in RB Investco’s parent company, may have the incentive to influence TMG in a way that could potentially act against the public interest in the UK by influencing the accurate presentation of news and free expression of opinion in the Daily Telegraph and the Sunday Telegraph newspapers.”

ALSO READ-UAE Braces For Rain, Strong Winds