Puri wondered whether the global economy is again going to witness a situation similar to the economic turmoil of 2008 which had become a self fulfilling prophecy…reports Asian Lite News

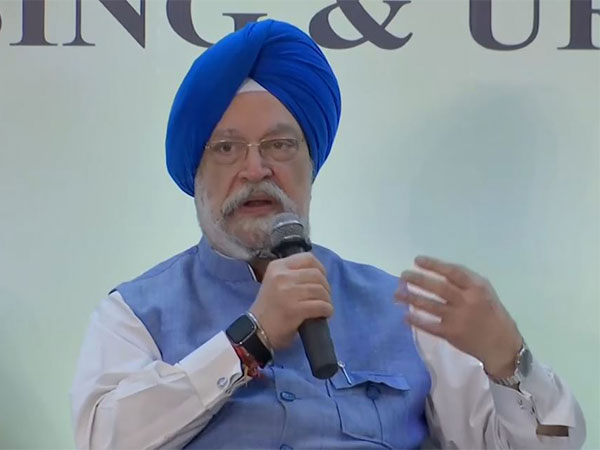

With OPEC and OPEC+ having reduced the availability of oil by 4.96 million barrels per day from the market since 2022, thus spiking brent prices from $72 per barrel in June to $97 per barrel in September 2023, Petroleum Minister Hardeep Singh Puri has called for infusing a sense of pragmatism and affordability in the oil markets.

During his meeting with OPEC Secretary General Haitham Al-Ghais on the sidelines of the ongoing annual Abu Dhabi International Petroleum Exhibition and Conference (ADIPEC) 2023, Puri urged OPEC to recognise the gravity of the current economic situation and called upon him to use his office to imbue a sense of pragmatism, balance and affordability in the oil markets.

During the discussions, the Petroleum Minister highlighted that due to the production cuts carried out by OPEC (10) and OPEC+ countries from August 2022 onwards, effectively around 5 per cent of the total global oil availability has been removed from the market, causing crude oil price to rise by 34 per cent in just last three months.

These cuts have been made despite growing energy demand, he said.

Brent crude oil prices jumped from $72 per barrel in June to $97 per barrel in September 2023, placing severe strains on the capacities of most oil importing consuming countries.

Puri, during his meeting with the OPEC chief, also highlighted that despite the geopolitical crisis of 2022, which has added to existing inflationary pressures and created a real risk of recession in large parts of the world, India, through positive intervention had effectively cushioned its economy from spiralling energy prices.

However he added that the world needs to be cognizant that around 100 million people have been pushed away from cleaner fuels, back to coal and firewood in the last 18 months.

Puri wondered whether the global economy is again going to witness a situation similar to the economic turmoil of 2008 which had become a self fulfilling prophecy.

Brent prices had initially soared from $93.60/bbl in January 2008 to $134.3/bbl in July 2008, fuelling an accelerated global economic meltdown, leading eventually to demand destruction and very low oil prices.

In the interest of global good, he advocated balancing global energy markets by ensuring that crude oil prices do not outstrip the paying ability of the consuming countries.