Asian Lite analyses the pros and cons of the Chinese Curbs on rare elements gallium and germanium. The two metals are part of a group of around 30 raw materials that are crucial for the green energy transition, digital hardware and defence production

The global community is alarmed by China’s curbs on gallium and germanium used in technology manufacturing which come into effect from Tuesday, August 1. The exports of gallium and germanium, two niche metals, would require licenses. The two metals are part of a group of around 30 raw materials that are crucial for the green energy transition, digital hardware and defence production.

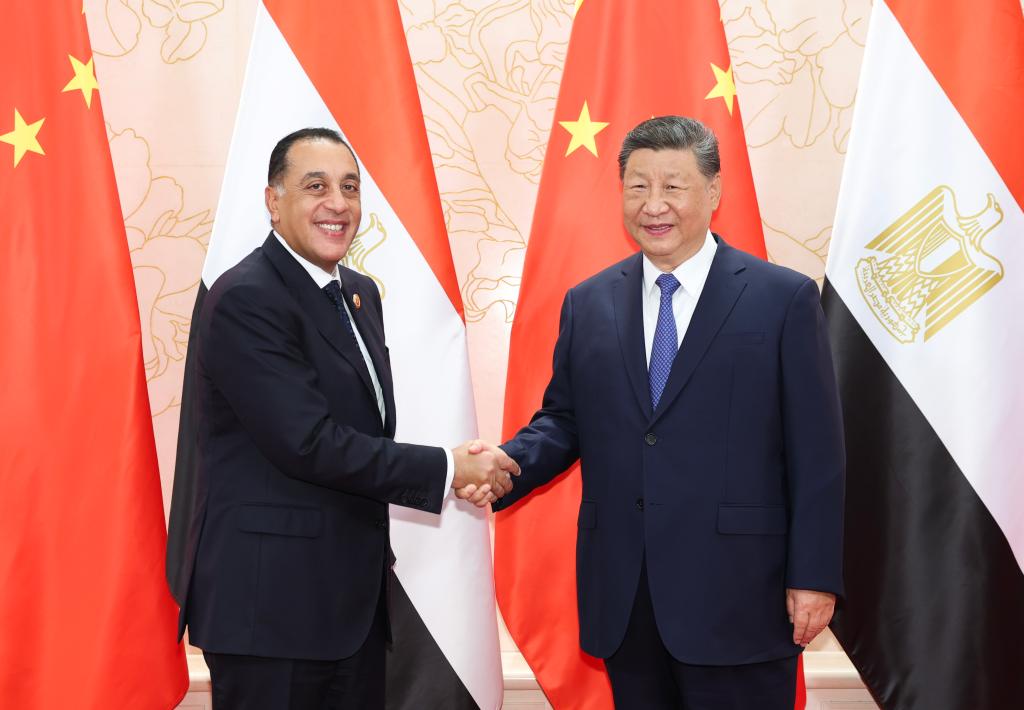

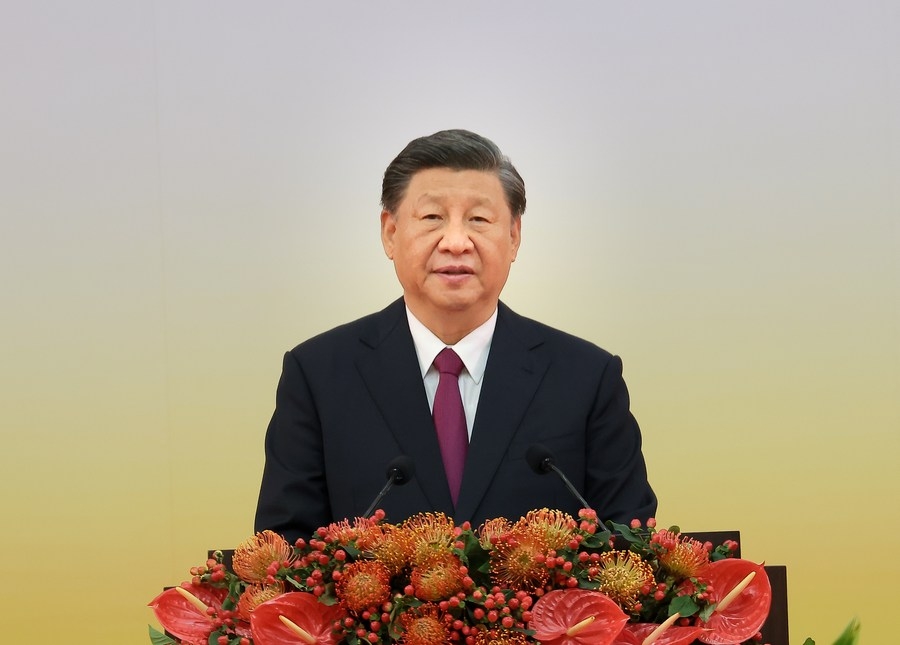

The Chinese Ministry of Commerce warned in early July stating that it would place export controls on gallium and germanium plus some compounds containing them, in order to safeguard national security and interests. It meant that anyone wishing to sell these materials outside China would first have to submit an application and obtain permission to do so. However, they are being widely viewed as retaliation for the blocks on technology exports to China by the US and other countries.

China is a major producer and exporter of rare earth minerals, which are essential in the production of various high-tech products like smartphones, electric vehicles, and renewable energy technologies. The concern arises from the fact that China’s control over these rare earth minerals could potentially give them significant leverage in global supply chains and trade. Also, it would have significant repercussions on industries worldwide, leading to supply shortages, higher prices, and disruptions in various sectors heavily reliant on these minerals. However, Governments and businesses around the world are worried about its impact on their economic and technological development as it would raise issues like dependency and fair trade practices.

Some experts find Beijing’s calibrated choice of curbing just two rare earth elements as a loud warning shot against the United States’ persistent no-holds-barred China-racking. Repeated rhetoric of not wanting to derail China’s rise only reminds Beijing of Michael Corleone’s line in The Godfather, “It’s not personal. It’s strictly business.”

Other Experts stated that China should keep in mind that things will not come to a standstill while restricting the exports of critical raw materials. It is beyond doubt that a full-fledged Chinese export ban on any critical raw material would send global prices for that substance spiking. For example, the temporary shutdown of some Chinese magnesium smelters in 2021 fuelled a 260 per cent rise in magnesium prices, affecting the automotive, aerospace, and other sectors. However, higher prices for critical raw materials whose production is dominated by China might not have as big an impact as many fear.

That’s because the monetary value of these commodities remains small. The issue with critical raw materials is their availability, not their price. Also, China’s domination of the sector stems from its strategy of flooding the market to depress prices. Higher prices for critical minerals would boost the competitiveness of non-Chinese producers and help them enter the market.

There are precedents: After gallium prices rose in 2021, a German company announced that it would restart production. The ban on export would certainly compel Western countries to find alternative suppliers which may take time and money. But there are reasons to be optimistic. China may be the leading producer of some critical raw materials, but it is not the only player in town, explained experts on economic affairs.

In a column in foreign policy, Agathe Demarais, global forecasting director at the Economist Intelligence Unit stated that Excluding rare earths, the EU relies on China for 65 per cent or more of its supply of five critical raw materials: bismuth, cobalt ore, magnesium, manganese, and strontium. Alternative suppliers for each of these materials exist and would probably be happy to ramp up production if global prices rose. Non-Chinese producers also exist for the six raw materials that will be the most critical for the global energy transition: lithium, graphite, cobalt, magnesium, nickel, and copper.

The largest known reserves for each of these minerals are outside China—in Australia, Chile, the Democratic Republic of the Congo, Indonesia, and Turkey. In addition, new deposits of critical raw materials could soon be discovered, as exploration spending rose by 20 per cent last year, fueled by investment from Australian and Canadian firms.

As far as processing infrastructure is concerned, Beijing’s threats would unintentionally speed up existing Western plans to build processing infrastructure, thereby undermining China’s dominant position.

Demarais said that the timing to develop new processing facilities outside China looks ideal. The global energy transition will boost demand for critical raw materials by four to six times in the 2020s. This situation presents a chance for producer countries such as Bolivia, Brazil, the DRC, Guinea, and Indonesia to move up the value chain by building processing facilities where the ores are mined. This, in turn, would be an opportunity for Western democracies to tackle China’s influence in developing economies.

More so, the Chinese export ban on critical raw materials may turbocharge collaboration between like-minded allies. Already there are signs of collaborations with the United States and Europe discussing ways to secure supplies of critical raw materials. According to available information, the EU has proposed setting up a buyers’ club for critical minerals—a cartel that would need to include both producers and other big consumers of critical raw materials such as the United States, Japan, and South Korea to be effective.

According to John Coyne of the Australian Strategic Policy Institute in Canberra, cooperation among like-minded countries will be crucial. Coyne argued that the goal, achieved through investment and cooperation, should be less reliance on China and more resilience and competition. Yet there is far to go before reaching even that modest aim. China’s hold is imposing, and the costs of entry into processing are forbidding. Even the boss of Raytheon Technologies (US), the world’s biggest maker of guided missiles, told the Financial Times that ending its reliance on Chinese supplies of critical minerals looked “impossible…We can de-risk but not decouple.”

Demarais however said that If China were to stop exports of raw materials, then Beijing, too, would suffer from serious reputational damage. By undermining Beijing’s repeated claims that Chinese economic projects come with no political strings attached, and that damage would not be restricted to critical minerals trade with the West.