Africa goes Lanka way. Between 2000 and 2020 alone, China lent a total of $59.87 billion to African countries and has become a largest creditor to Angola, Ethiopia, Zambia and Kenya, reports by Dr Sakariya Kareem

In the wake of developing African economies struggling to repay their debts to China, outgoing World Bank President David Malpass recently remarked that the debt that these countries owe to China was unsustainable and lacked transparency in terms and conditions.

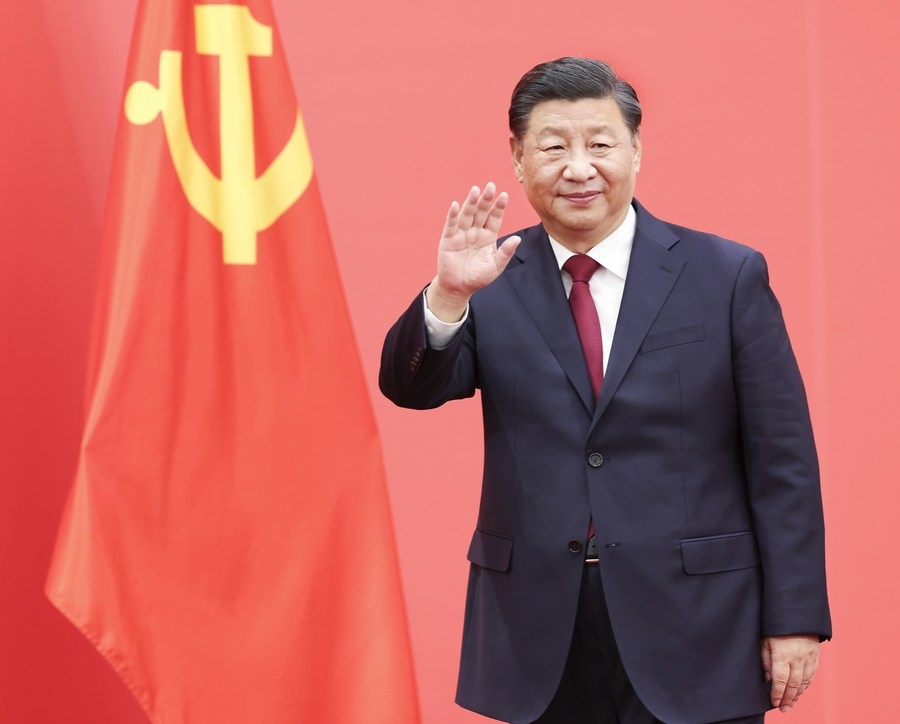

He warned of increase in defaults in repayments by these countries due to higher food, fertiliser and energy prices, as a result of the war in Ukraine. Between 2000 and 2020 alone, China lent a total of US $159.87 billion to African countries and has become a largest creditor to Angola (US $42.6 billion), Ethiopia (US $13.7 billion), Zambia (US $9.8 billion) and Kenya (US $9.2 billion), which are now struggling to meet their debt obligations.

The crisis is worrying as most African countries with Chinese loans are witnessing a repayment crisis and are seeking deferment of interest payments and re-negotiating loan terms. In fact, Zambia has already defaulted on its debt and debt restructuring talks have made little progress due to the hesitancy of Chinese state owned banks. Kenyan officials and ministers have reiterated that they would ask China to extend the repayment period on $5 billion worth of loans, as the debt is “choking” the country’s economy.

Djibouti’s total debts to China equate to around 43% of its GDP and recently announced it was suspending payment on $1.4 billion in Chinese loans. US Treasury Secretary Janet Yellen has reiterated on multiple occasions that China has become the biggest obstacle to progress in these countries.

According to researchers at Chatham House, huge Chinese lending to Africa has created a dilemma for China as it struggles to recoup its money and at the same time present itself as a friendly nation. They warned that China could resort to more unilateral actions by appropriating significant native assets such as ports, railways or power networks in response to defaults.

The lack of transparency in these agreements is another major problem. According to a study by the Center for Global Development, a Washington-based think-tank, in collaboration with AidData, all of the contracts of China Development Bank and 43% of the deals signed by Export-Import Bank of China included confidentiality clauses about the terms of the loans.

Moreover, AidData reported that half of China’s lending to developing African countries is not reported in official debt statistics.

Further, the loans provided by China come at higher rates of interest than western sources. At around 4%, these loans are close to commercial market rates and about four times that of a same type of loans from the World Bank or Western country. Moreover, the repayment period in case of a Chinese loan is generally less than 10 years, as compared to around 28 years for other concessional loans provided by other institutions to developing African countries. Findings also showed Chinese loans require borrowers to create special accounts with cash balance that China can seize in case of default.

The announcement by China last year that it is forgiving 23 loans for 17 African countries, is probably just a goodwill gesture and could have been motivated by accusations of ‘debt-trap diplomacy’. According to Deborah Brautigam, Director of the China Africa Research Initiative at Johns Hopkins University’s School of Advanced International Studies, this is not a loan cancellation per se, but the cancellation of the remaining unpaid portion of interest-free loans that have reached maturity. Brautigam’s research shows that this applies only to Chinese government interest-free loans and not interest-bearing commercial loans.

It is reported that the amount of these loans was not even 1% of China’s total lending to the continent. China’s decision does little to alter Africa’s growing indebtedness.

China’s debt diplomacy is not only a threat to natural assets of the African countries but also a threat to these countries sovereignty. Unsustainable debt and the constrictive terms of Chinese loans have come under increased scrutiny in recent years as more governments have signed deals with China. Concerns have particularly focused on some clauses that allow Chinese entities to seize property or assets when there are defaults.

The problem has become even more acute due to steep increase in interest rates in the US and other major economies over the last year and relative fall in value of the currencies of these African countries, making loans offered in dollar and other currencies expensive.

Moreover, the economic recession due to the pandemic and Russia’s invasion of Ukraine has undermined the ability of many African nations to service their sovereign debts. According to Chatham House, at present 22 low-income African countries are either already in debt distress or at high risk of debt distress.