The company also demanded the clearance of the amount before March 24 since the approval of foreign exchange conversion from the State Bank of Pakistan for making payment to the lender takes time….reports Asian Lite News

A state-owned Chinese firm registered in Pakistan has expressed concern over delay in their payment and asked the Pakistan Ministry of Energy (power division) to release Pakistani Rupees (PKR) 12.35 billion as Transmission Service Payment.

The China Electric Power Equipment and Technology Co Ltd (CET), registered in Pakistan as Pak Matiari-Lahore Transmission Company Private Limited (PMLTC), has expressed their concern at this issue. The companies also asked the ministry to prioritise this issue, Pakistani newspaper Dawn reported on Wednesday.

But National Transmission & Despatch Company (NTDC), on other hand, claimed that no payment is pending on its part.

In a recent letter to energy minister Hammad Azhar, the company explains that it has received the TSP for September to November 2021 and a partial payment of 19.46 per cent for the month of December 2021.

It also informs the minister that in accordance with the Transmission Service Agreement (TSA), by the beginning of March 2022, the companies should have received the TSP from September 2021 to February 2022 along with payment for adjustment of indexation.

Moreover, the TSP for the pre-CoD (commercial operation date) period that remained pending is at PKR 21.1 billion, while the payment company received so far is PKR 8.75 billion which amounts to 41.4 per cent of the total amount it billed, according to Dawn.

The letter also reads, “We need to stress again that the total amount of invoices we billed NTDC is PKR 21.21bn, out of which, after receipt of PKR 8.75 billion, the unpaid amount is PKR 12.35bn.”

The company also demanded the clearance of the amount before March 24 since the approval of foreign exchange conversion from the State Bank of Pakistan for making payment to the lender takes time.

“This issue emerged before my appointment as Managing Director. However, we always give priority to such payments. And we did,” NDTC MD was quoted as saying by Dawn.

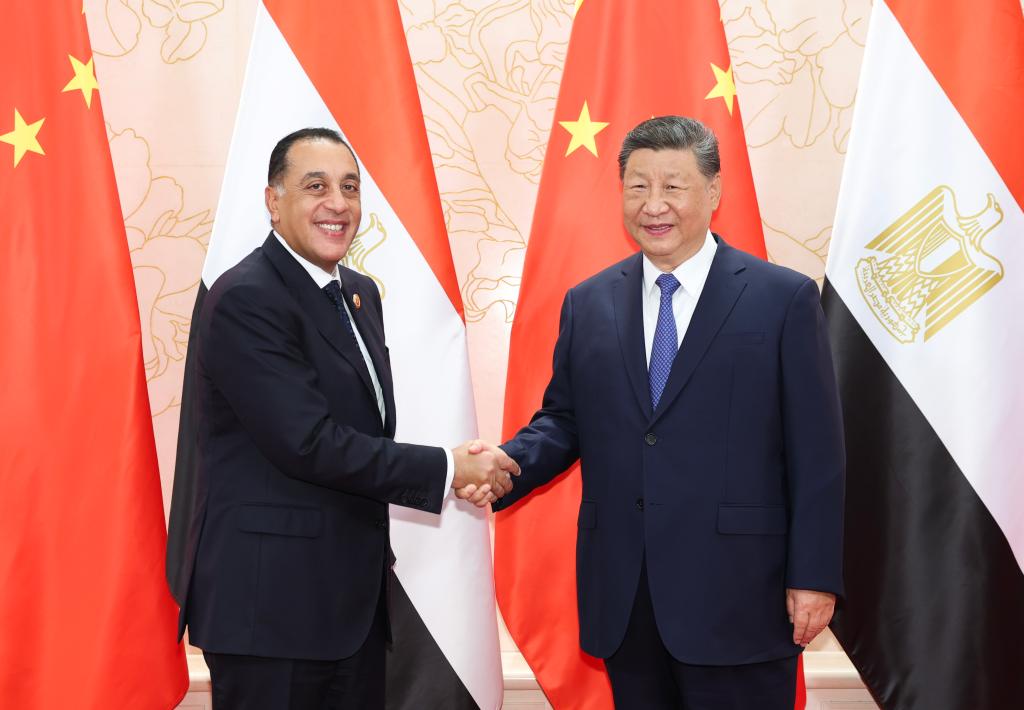

Meanwhile, Pakistan has sought financial support of about $ 21 billion from China.

Islamabad has requested a rollover of existing loans of $ 10.735 billion and $ 10 billion as deposit fund, to meet future needs, Business Recorder reported citing sources on Tuesday.

During the Pakistan Prime Minister Imran Khan’s visit to China in February, several agendas were discussed including a rollover request of all financing facilities upon maturity. One SAFE (China’s State Administration of Foreign Exchange) deposit of USD 2.0 billion will be maturing on March 23, 2022.

Likewise, a 3-year commercial loan of People’s Renminbi (RMB) 15 billion equivalents to USD 2.235 billion from a consortium of China Development Bank (CDB), Bank Of China and Industrial and Commercial Bank of China Limited (ICBC) is maturing on March 25, 2022.

Moreover, the State Bank of Pakistan has proposed the enhancement of the currency swap arrangement to USD 15 billion.

Pakistan’s devastating economic condition forced the country to seek loans from different countries. China and Saudi Arabia had already granted a huge loan to Pakistan in the past few years. In December 2021, Saudi Arabia granted a loan of USD 3 billion to Pakistan. (ANI)