The mounting financial pressure has also raised concerns that the country may have to hand over lucrative assets if it fails to meet its repayment obligations…reports Asian Lite News

Like Sri Lanka, Kyrgyzstan also has a swelling state debt and took on billions worth of loans over the last decade from China’s Export-Import Bank for a series of infrastructure plans under the Belt and Road Initiative (BRI), Chinese leader Xi Jinping’s signature policy, which he once dubbed “the project of the century”, media reports said.

Kyrgyzstan’s debt currently sits north of $5.1 billion, according to the Foreign Ministry, 42 per cent of which is owed to Beijing. But Bishkek is struggling to cope with a contracting economy and has so far failed to yield a commercial return on the projects backed by its huge Chinese loans. This has prompted fears the country will be unable to pay off its loans or even meet interest payments. The mounting financial pressure has also raised concerns that the country may have to hand over lucrative assets if it fails to meet its repayment obligations.

That warning comes as sovereign-debt distress spreads in several countries along the BRI, prompting China’s first overseas debt crisis as it grapples with a mounting pile of non-performing loans and increased scrutiny of how Chinese lending has exacerbated economic pressures on vulnerable governments, RFE/RL reported.

“There’s no doubt that the Chinese Ministry of Finance and central bank are looking at their dashboards and their red lights are going off right now,” Bradley Parks, Executive Director of the AidData Lab at the College of William and Mary in Virginia, told RFE/RL.

The globe-spanning scale of BRI, which was launched in 2013 by Beijing as the largest infrastructure program undertaken by a single country, has left it with a list of risky debtors around the world — including Argentina, Pakistan, Russia, Tajikistan, Venezuela, Zambia, and Iran — that hoped to take advantage of the surge in Chinese overseas lending but now find themselves struggling with a debt crisis the World Bank has warned could trigger a series of defaults not seen since the 1980s.

“China is growing more concerned about it not being able to get paid back, so we have seen a pullback in lending that is set to accelerate,” Alicia Garcia-Herrero, the chief economist for Asia-Pacific at the investment bank Natixis, told RFE/RL. “China is also under growing economic pressure at home now and is becoming more hesitant to lend to risky countries. (This) has (opened) a new phase of the BRI.”

The BRI has helped make China the world’s largest bilateral lender and seen it give out loans totaling $932 billion since it was established eight years ago, according to data collected by the Green Finance and Development Center at Fudan University in Shanghai, RFE/RL reported.

Loans issued in recent years are turning bad at an unprecedented rate, with research by Rhodium Group, a New York-based research consultancy, showing that the value of Chinese loans that required negotiation soared to $52 billion in 2020 and 2021, a threefold increase from the previous two years.

Data compiled by William and Mary’s AidData Lab, which maintains one of the most comprehensive datasets on Chinese development finance, also shows the current scale of the debt crisis, with its research indicating 60 per cent of Chinese loans are to countries in financial distress, compared to only 5 per cent in 2010 before the BRI was launched. Other research by AidData shows that 35 per cent of the BRI infrastructure projects currently face major implementation problems.

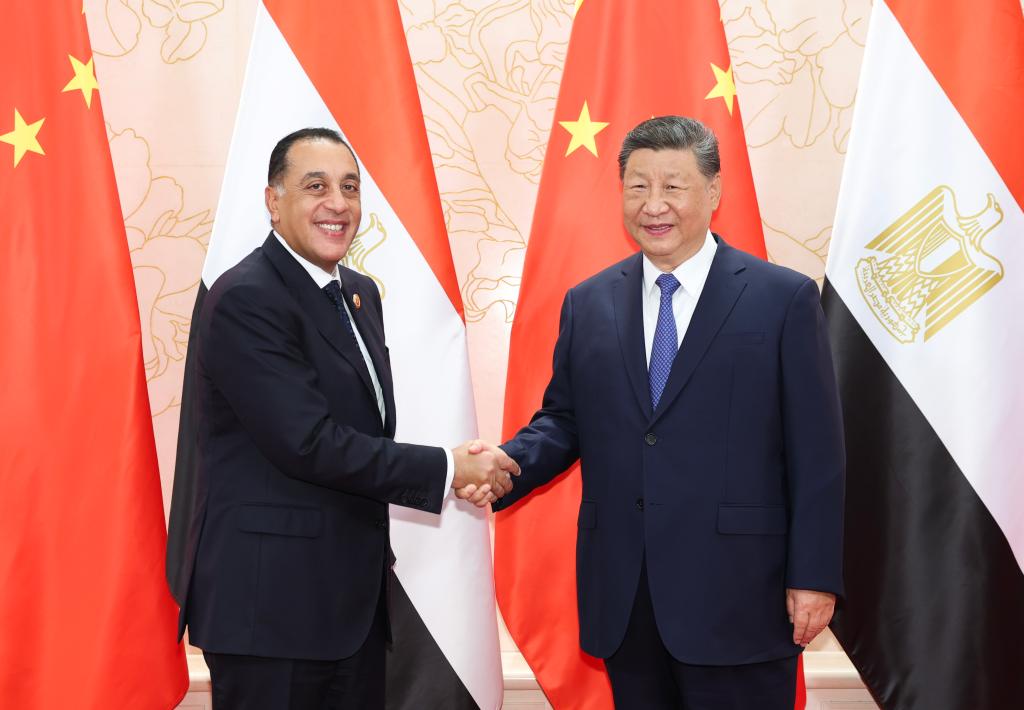

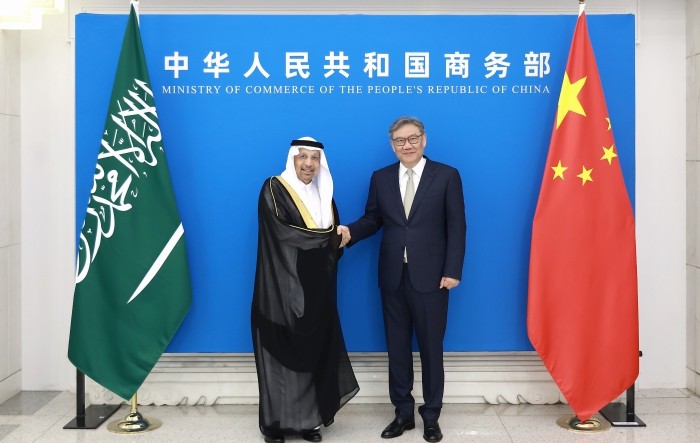

In the face of such pressures, Beijing has begun to issue so-called “rescue loans” to starve off defaults, with AidData showing that tens of billions of dollars have been issued by Chinese state institutions to countries such as Pakistan, Belarus, Egypt, Mongolia, Turkey, and Sri Lanka, to help service their loans and avoid default, RFE/RL reported.

“We are at a major pivot point right now. The scale of this widespread debt pressure is something that China has never faced before and it is having to reinvent BRI on the fly,” Matthew Mingey, senior research analyst at Rhodium Group, told RFE/RL.

ALSO READ-China’s BRI spending falls to $28.4 bn