The World Bank argued that Chinese authorities should stand ready to ease fiscal policy and provide liquidity to stem risks of contagion from distressed developers….reports Asian Lite News

China’s economic growth has been given a bleak picture by World Bank’s report on Wednesday as the world’s second-largest economy faces mounting headwinds from the new Omicron variant to a severe property sector downturn.

The World Bank now expects China’s GDP to expand 8 per cent in 2021 compared with a year ago — that’s lower than its previous forecasts. (In October, the World Bank expected China to grow 8.1 per cent this year. In June, it projected a growth of 8.5 per cent), according to CNN.

Earlier, it also cut its 2022 forecast from 5.4 per cent to 5.1 per cent, which would mark the second slowest pace of growth for China since 1990 — when the country’s economy increased 3.9 per cent following international sanctions related to the 1989 Tiananmen Square massacre.

“Downside risks to China’s economic outlook have increased,” the World Bank said.

Further, the World Bank argued that Chinese authorities should stand ready to ease fiscal policy and provide liquidity to stem risks of contagion from distressed developers.

China was the only major economy to record growth in 2020, but this year it has been dealing with a lot of threats to its expansion, including pandemic-related curbs, an energy crunch, and an unprecedented crackdown on private enterprises.

Increasing economic headaches have made Beijing reconsider its approach to policy.

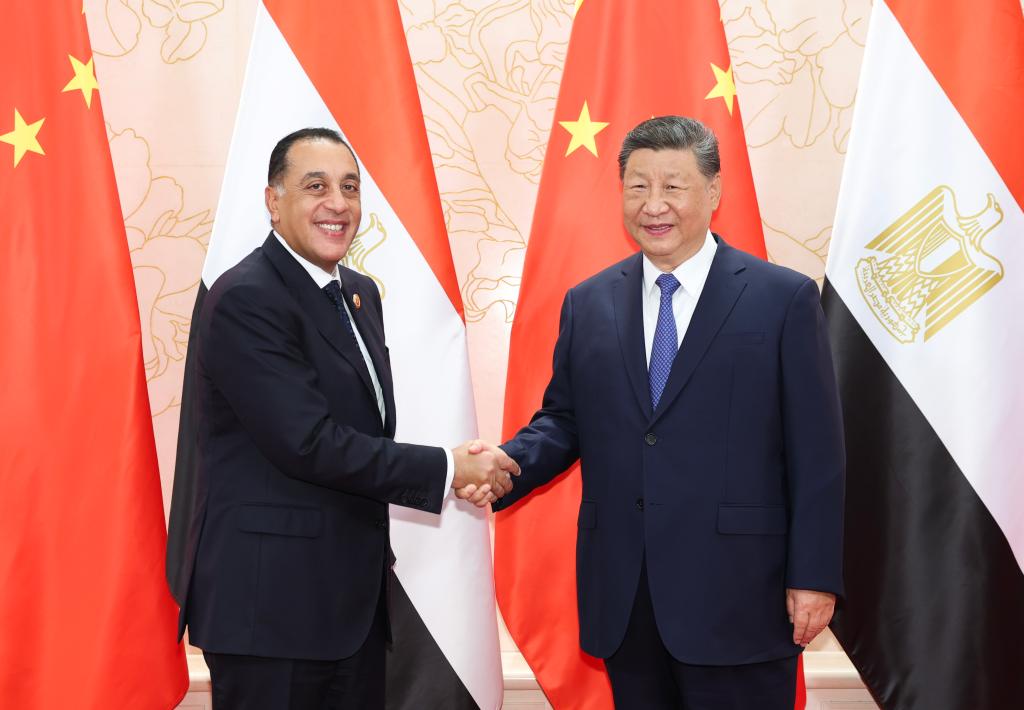

During a key economic meeting earlier this month, Chinese President Xi Jinping and other top leaders marked “stability” as their top priority for 2022, according to CNN.

On the other hand, the People’s Bank of China on Monday cut its main interest rate for the first time in 20 months, hoping to reduce borrowing costs for households and firms and in turn encourage consumer spending and investment.

Last week, the central bank also lowered the reserve requirement ratio for most banks by half a percentage point. That move is expected to unleash some 1.2 trillion yuan ($188 billion) for business and household loans, according to CNN. (ANI)