During the last financial year, India attracted $5.64 billion in FDI from Mauritius…reports Asian Lite News

The US replaced Mauritius as the second-largest source of foreign direct investment (FDI) into India during 2020-21 with inflows of $13.82 billion, according to government data. Singapore remained the top source of foreign direct investment into the country for the third consecutive fiscal at $17.41 billion.

During the last financial year, India attracted $5.64 billion in FDI from Mauritius, according to the data by the Department for Promotion of Industry and Internal Trade (DPIIT). The island country was followed by UAE ($4.2 billion), Cayman Island ($2.79 billion), Netherlands ($2.78 billion), UK ($2.04 billion), Japan ($1.95 billion), Germany ($667 million), and Cyprus ($386 million).

Overall foreign direct investments into the country grew 19 percent to $59.64 billion during 2020-21 amid measures taken by the government for policy reforms, investment facilitation and ease of doing business. Total FDI, including equity, re-invested earnings and capital, rose 10 percent to the highest-ever $81.72 billion, as against $74.39 billion in 2019-20.

In 2020-21, the computer software and hardware sector attracted the highest inflows of $26.14 billion. It was followed by construction – infrastructure activities ($7.87 billion) and services sector ($5 billion). Commenting on the data, Mithun V Thanks, Partner – M&A, Private Equity and General Corporate at Shardul Amarchand Mangaldas & Co, said tax reasons aside, US-based entities have historically been bullish on the India story.

“This is expected to continue in the next few years, with the pandemic driven focus on increased tech adaptation and integration. Silicon Valley will continue to weave many a-billion-dollar sized dreams, at the sheer size of the Indian market – and added to the cash crunch at the domestic level – should present agreeable valuations,” he said.

He added that with the increased cash being introduced in the US economy, it is likely that a chunk of this will flow into India as well. “The prevailing polity of anti-China sentiments in India (and in the US) is likely to provide the continuing last-mile impetus,” he said.

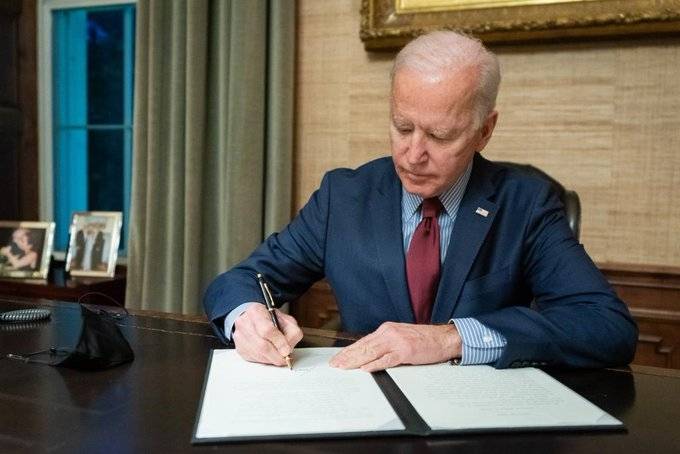

ALSO READ: Biden pitches mammoth $6 trillion budget