The country’s overall level of debt is driven primarily by real estate, corporates and shadow banking. China’s overall debt is difficult to assess as a large part of it is borne by the local governments and state owned enterprises…reports Mahua Venkatesh

Will Beijing come to the rescue of Chinas real estate behemoth Evergrande Group?

The problem has arisen amidst rising debt levels in the Chinese economy at a time when Beijing has been pushing ahead with its ambitious BRI objects to gain geopolitical clout.

While the Chinese government bailed out the state-owned Huarong Asset Management with total liabilities estimated at $238 billion it has not disclosed its cards on the Evergrande Group.

Huarong had announced its annual financial statements after a four-month delay, showing a 90 per cent drop in profits year on year.

“Effectively, the firm was on the chopping block for default and Beijing had a Lehman-sized issue on its hands,” the Diplomat, in an article, said. Beijing after much deliberation, stepped in to save the company with fresh capital of $7.7 billion from Citic Group — formerly the China International Trust Investment Corporation — and other state owned enterprises.

Forbes noted that for American observers, the Huarong rescue might compare to the March 2008 U.S. government-orchestrated salvage of Bear Stearns (the distressed investment bank).

Within a month, Evergrande Group, which owes over $300 billion, hit headlines. As investors and the global business community keenly watch the developments, Beijing has not indicated whether it would be willing to help the real estate major.

“By bailing out its most bloated property developer right now, Beijing would shoot itself in one foot to save the other. A $300 billion bailout would just transfer the liability to the government and worsen the government’s pre-existing debt hangover,” the Diplomat noted.

China’s overall rising debt problem

Rising debt public as well as private has become a cause for serious concern for China. Reports have suggested that about $1.3 trillion is the estimated Chinese corporate debt that would be due in 12 months.

The Washington-based Institute of International Finance (IIF) in 2019 said that China’s debt topped 300 per cent of GDP. This included debt across all sectors such as household, government, financial and non-financial corporate.

The country’s overall level of debt is driven primarily by real estate, corporates and shadow banking. China’s overall debt is difficult to assess as a large part of it is borne by the local governments and state owned enterprises. “The central government is not overleveraged and benefits from ample foreign currency reserves. But regional governments have expanded unsafe financial operations since 2007, and often resort to off-the-counter loans or shadow banking.

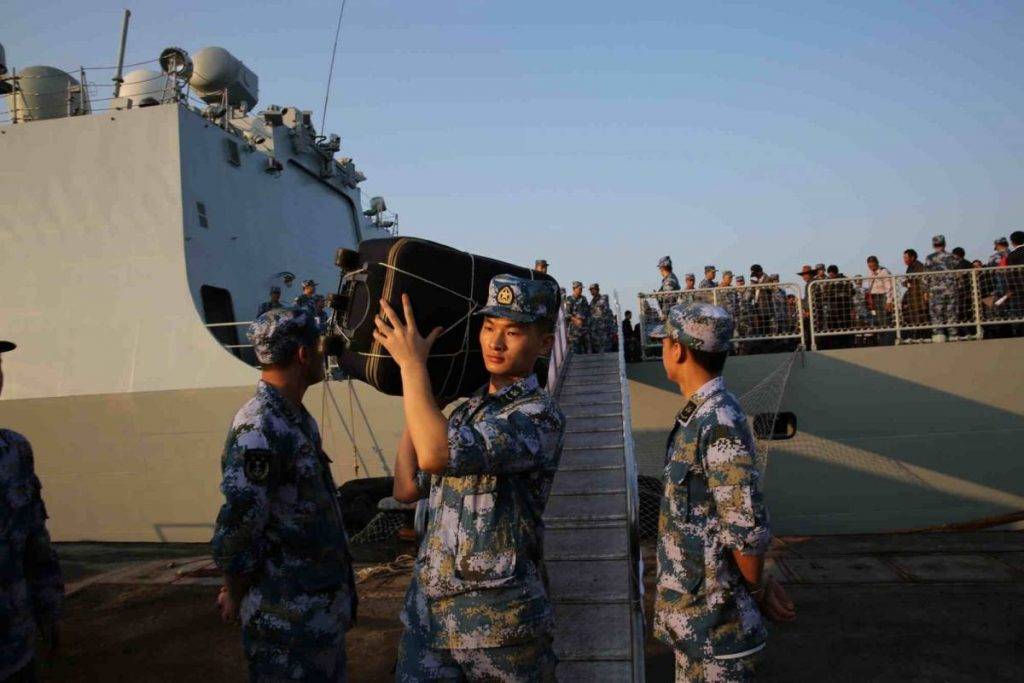

To add to the problem, China’s ambitious Belt and Road Initiative (BRI), is mostly funded by its local governments and SOEs.

Several countries which received loans from China either for the BRI projects or other infrastructure initiatives have been unable to repay their debts due to the Covid 19 pandemic. Large part of such debt had to be restructured, analysts pointed out.

“The problem with China is lack of transparency in the lending amount or pattern. Therefore, it is difficult to come to any clear assessment but logically speaking, it would be a problem for Beijing to address the debt situation, which in turn would impact lending towards BRI,” an analyst told India Narrative.

Though China has turned into a major global lender, it is not a member of the Paris Club– an informal group of creditor nations with the aim to strike workable repayment solutions. Not just that. The country is also not part of the Organisation for Economic Co-operation and Development (OECD). Both Paris Club and OECD maintain loan records of official creditors.

“Debt, whether public or private, does seem to be an Achilles heel for China, and accounting practices and reporting are murky,” Voice of America quoted Doug Barry, a spokesperson for the U.S.-China Business Council as saying.

(The content is being carried under an arrangement with indianarrative.com)