The higher interest rate will reportedly cost Pakistan $24 billion more compared to what the country paid in 2018 when Saudi Arabia had given a $6.2 billion loan to Pakistan .” ..writes Mrityunjoy Kumar Jha

A day after the Imran Khan led government celebrated Saudi Arabia’s $4.2 billion cash loan and hailed it as a symbol of brotherly relations between Pakistan and Saudi Arabia, Pakistani experts have been calling it a damp squib because of the harsh terms and conditions put by Saudi Arabia.

Pakistan has accepted tough conditions for loan repayment: it would have no rollover option and will have to repay the $3 billion loan one year after the date of deposit with a caveat that Pakistan would be bound to return it any time at a 72-hour notice.

The damaging pre-condition of Saudi Arabia’s loan, according to Pakistani experts, is that “in case of a dispute, Saudi law will be applicable. Pakistan has surrendered its sovereign claim of immunity from suit, execution, attachment or other legal processes in relation to the $3 billion cash deposit agreement.”

Experts are also questioning the high interest rate being charged by Saudi Arabia, unlike previous loans which were almost interest free.

The higher interest rate will reportedly cost Pakistan $24 billion more compared to what the country paid in 2018 when Saudi Arabia had given a $6.2 billion loan to Pakistan

“Pakistan calls Saudi Arabia its brother but Saudi Arabia’s preconditions to Pakistan on the $4.2 bn loan, only signifies that Pakistan has no credibility left and stands isolated diplomatically and economically, on the brink of collapse,” says Azim M Mian, a Pakistani financial expert.

ALSO READ: Blacklisted Chinese firm alleges nepotism in Pakistan

Under the agreement Pakistan will repay $3 billion to Saudi Arabia no later than one year from the date of the deposit. Saudi Arabia can also demand the immediate return of the money in case of a sovereign default by Pakistan.

According to a report by Express Tribune, the failure by Pakistan to comply with any provision of the cash deposit agreement will lead to a default. Also, Pakistan’s failure to service the public external debt of over $100 million will be deemed as a default.

The Pakistani Finance Ministry, in its statement justified that every memorandum of understanding (MOU) contains dispute resolution provisions. “It does not mean that the country’s sovereignty has been compromised.”

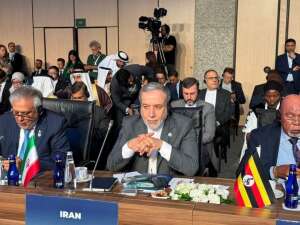

Saudi Arabia announced the $4.2 billion package for Pakistan in October after Prime Minister Imran Khan and his team visited Riyadh and met with Saudi Crown Prince Mohammad Bin Salman.

Saudi Arabia had ended its loan and oil supply to Pakistan due to Pakistani Foreign Minister Shah Mehmood Qureshi’s criticism that the Saudi-led Organisation of Islamic Cooperation (OIC) was not doing enough to pressure India on the Kashmir issue. Pakistan had to borrow from China to repay the loan back to Saudi Arabia.

(The content is being carried under an arrangement with indianarrative.com)